Wildfire Insurance Mitigation for Homeowners

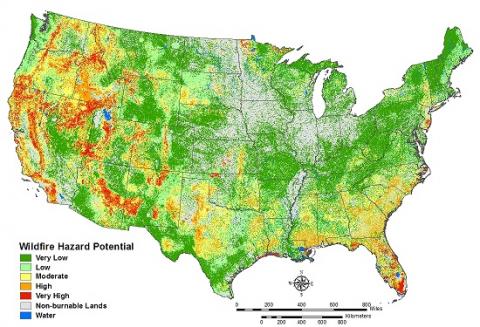

Wildfires are a real risk to millions of homeowners across the United States. Each year, wildfires cost homeowners and insurers billions of dollars in damage. Though some states are more likely to experience extreme damage, the map is well spread with moderate to severe risk across the Western and Southern United States. So do you need wildfire insurance coverage?

Insurance Coverage for Wildfires

A typical homeowners insurance policy covers damage from fire and smoke. Wildfire damage can fall under several categories in your policy that may include coverage for personal property, dwelling, landscape recovery, and additional living expenses (when you are displaced from your home during the repair process).

Deductibles and coverage limits will apply, and high-risk areas may also play a role in who will provide your insurance and how those limits work. An agent can help you navigate your best coverage and assess your needs. As with claims after all catastrophic damages, a home inventory is a must to ensure your belongings can be reimbursed.

Lower Your Risk of Wildfire Damage

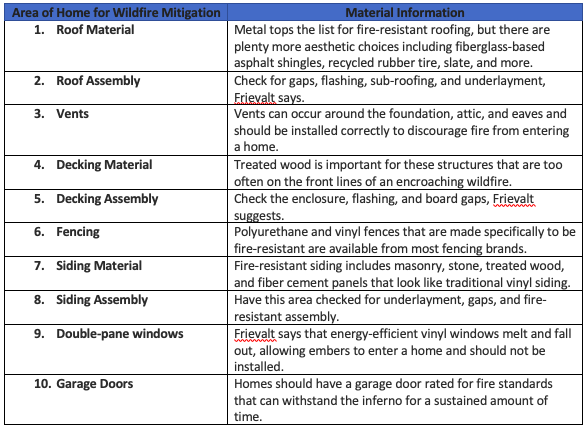

As unpredictable and unstoppable as wildfires seem, there are ways homeowners can help lower the amount of damage caused by these raging giants. The Insurance Information Institute (III) interviewed influential Fire Chief Frank Frievalt, a California first responder who is on the front lines working with insurance leaders to understand and respond to wildfire risk.

In his interview, Frievalt shared ideas for fire mitigation with the III. He says the research is ongoing so there’s no definitive list yet, but these are a good start. Making certain areas in your home as fire resistant and secure as possible is an important step towards protecting your property from wildfire damage. Here’s an augmented list of the ideas Frievalt shared:

Homes built before 2008 may need to be retrofitted for safety, Frievalt also shared. He’s part of an ongoing task force that is the result of a partnership between the Western Fire Chiefs Association and the insurance organizations ISO and Interra. Key areas to consider to protect your home include the roof and the windows/doors. Windows and doors also provide an easy point of entry for fire, so replace PVC and timber with aluminum strong enough to stay in place and keep fire out.

Wildfire Risk by the Numbers

California may immediately come to mind when you think of wildfire risk, but recent statistics showed other surprising names. In 2018, the top ten states for the most wildfires were: Texas, California, North Carolina, Georgia, Florida, Oregon, Arizona, Washington, Oklahoma, and Minnesota.

The time of year can also play an impact on wildfire risk. 9 out of the 10 costliest fire disasters in US history occurred between October and December.

Protect Your Property

Having a conversation with your agent is a good way to understand your policy limits and deductibles, as well as your area’s wildfire risk. Fudge Insurance works with clients across several wildfire-prone states, including Texas, Arizona, and Colorado. We’re here to help navigate the homeowners insurance process with you, whether you’re just joining our family or have been with us for years. Contact us for any questions or policy requests.